Coping alone

Dealing with loss of a life partner after death or divorce can be totally overwhelming.

And to make matters even worse, the time when you are feeling the most vulnerable, frightened and alone, is also the time when many crucial financial decisions often have to be made very quickly.

If you haven’t been the spouse who managed the finances in your household, this can be paralyzing. Whether it’s trying to work out what how to keep running your self managed super fund by yourself or even paying a bill online, we can help you get back on your feet.

You are not alone

The good news is, you are not alone when it comes to securing your financial future. At ITL Financial Planning we have safely guided many clients through this difficult time in their lives.

And we can also help you, regardless of whether it is the first time in your life you have had to make decisions about finances or even if you are used to making financial decisions but are momentarily overwhelmed with grief.

A trusted financial partner

We can provide you with both confidence and peace of mind as you adjust to a different future to the one you previously imagined.

At ITL Financial Planning we know which financial decisions you need to make now and which financial decisions can wait until you feel ready and able to focus on your financial future.

We will liaise with your lawyer, accountant, bank manager and any other professional partners to help you quickly and easily organise all the urgent aspects of your changed financial circumstances, such as:

- changing bank account names

- sorting out wills and probate

- applying for benefits, if necessary

- reviewing your existing loans or financial obligations

- life insurance and superannuation claims

Take away the stress of an uncertain financial future

Dealing with loss of a life partner after death or divorce can be totally overwhelming.At ITL Financial Planning we take the time to listen, understand, and focus on you and your needs, allowing us to help you alleviate any uncertainty about your long-term financial future.

And we won’t rush you into any long-term financial decisions, because at ITL Financial Planning we believe in:

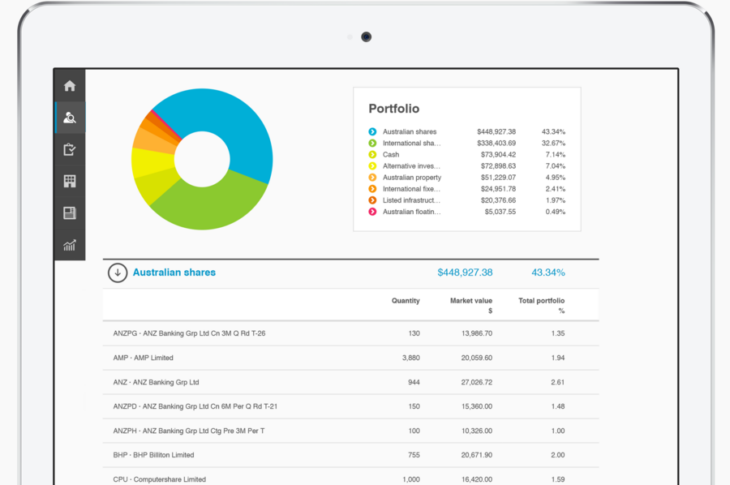

- careful and considered planning and investing at the level of risk you feel comfortable with

- a one-to-one, consultative service based on a relationship of trust and understanding

- fully tailored solutions that puts your interests first

If you are looking take away the stress of an uncertain financial future and develop a trusted relationship with a professional financial planner who will take the time to listen, contact us now.

We would love to help.

ITL Financial Planning and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. www.fortnum.com.au. Any information on this website is general advice only and does not take into account any person's objectives, financial situation or needs. Please consider your own circumstances and consider whether the advice is right for you before making a decision. Always obtain a Product Disclosure Statement (if applicable) to understand the full implications and risks relating to the product and consider the Statement before making any decision about whether to acquire the financial product.